Going into last week, I was nuetral...and wanted 8350 before looking to go short.

Waiting for a 200pts dow pop..on "MOST" cases is a "usually" pretty safe way to play things, especially on an expiration week. (just as waiting for a 200pts down swing to go long would be).

.........How the market humbles you.

Waiting for a 200pts dow pop..on "MOST" cases is a "usually" pretty safe way to play things, especially on an expiration week. (just as waiting for a 200pts down swing to go long would be).

.........How the market humbles you.

...

Looking ahead to next week......

If the DOW can take out 8877

If the RUT can take out 535

If the SPX can take out 956

If those 3 happen, then I will "change my tune" on my intermediate term setiment and NOT be in "short the pops mode". (in other words, those 2009 highs-are my "mental stops" for the intermediate broad market trend)

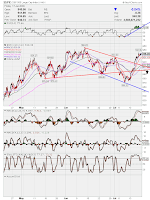

As for the short term, I think even the most bullish scewed opinion sees a likely pullback ahead here. The cleanest bullish longer term set up, could be that all indices pull back and find support on TOP of all the old wedges from which they broke out. Which would be

1) the top of the channell

2) the old "neck line support"

In other words, if 1) does not hold......I think that it heads to 2)

Even if every single index heads to 2)....the intermediate UP trend is still in place.

(see charts)

RUT: 510, then 500

COMP: 1850, then 1820

NDX: 1485, then 1470

INDU: 8500, then 8400

SPX: 905 (1 & 2 are one in the same)

If we do get these levels short term, I will then move to nuetral for the short term and then let the market decide what the intermediate trend is. However due to the intermediate signals from:

A) the VIX continuing to make NEW lows, yet the SPX not a NEW highs

B) the Issue:Volume ratio >3

Because of those 2 signals, on the Intermediate term I still do favor the bearish side. However I am just playing it short term bearish to those index number pullback targets, then I will wait and see what the market wants to do.

When there are Intermediate signals that say SELL, and let's say Short term signals that are mixed, I lean to the SELL side. (especially if we just had a huge move up short term)

I am sure there are many EWT traders who are labeling last weeks' move a "wave 1", as it was the first "impulsive move up" in quite a long time. Hence in theory that would be followed by a wave 2 pull back, then a wave 3 ROCKET RIDE upwards. I am not an EWT trader, so I have no clue in that regard. But with combination of news and charts, its hard to imagine a stronger up-move than that as we get into the 2nd and 3rd tier companies earnings reports...just my 2 cents.

As far as Sentiment wise, I just don't see the "probability" of another week of

-GS blow out

-INTC great numbers

-Perfectly timed M.Whitney pump

-Very well spun Roubini twist/pump

....all together launching all like a firecracker trigger, set-off to explode in sequence just after TOO may people jumped into the "head and shoulders" breakdown "set up".

Looking ahead to next week......

If the DOW can take out 8877

If the RUT can take out 535

If the SPX can take out 956

If those 3 happen, then I will "change my tune" on my intermediate term setiment and NOT be in "short the pops mode". (in other words, those 2009 highs-are my "mental stops" for the intermediate broad market trend)

As for the short term, I think even the most bullish scewed opinion sees a likely pullback ahead here. The cleanest bullish longer term set up, could be that all indices pull back and find support on TOP of all the old wedges from which they broke out. Which would be

1) the top of the channell

2) the old "neck line support"

In other words, if 1) does not hold......I think that it heads to 2)

Even if every single index heads to 2)....the intermediate UP trend is still in place.

(see charts)

RUT: 510, then 500

COMP: 1850, then 1820

NDX: 1485, then 1470

INDU: 8500, then 8400

SPX: 905 (1 & 2 are one in the same)

If we do get these levels short term, I will then move to nuetral for the short term and then let the market decide what the intermediate trend is. However due to the intermediate signals from:

A) the VIX continuing to make NEW lows, yet the SPX not a NEW highs

B) the Issue:Volume ratio >3

Because of those 2 signals, on the Intermediate term I still do favor the bearish side. However I am just playing it short term bearish to those index number pullback targets, then I will wait and see what the market wants to do.

When there are Intermediate signals that say SELL, and let's say Short term signals that are mixed, I lean to the SELL side. (especially if we just had a huge move up short term)

I am sure there are many EWT traders who are labeling last weeks' move a "wave 1", as it was the first "impulsive move up" in quite a long time. Hence in theory that would be followed by a wave 2 pull back, then a wave 3 ROCKET RIDE upwards. I am not an EWT trader, so I have no clue in that regard. But with combination of news and charts, its hard to imagine a stronger up-move than that as we get into the 2nd and 3rd tier companies earnings reports...just my 2 cents.

As far as Sentiment wise, I just don't see the "probability" of another week of

-GS blow out

-INTC great numbers

-Perfectly timed M.Whitney pump

-Very well spun Roubini twist/pump

....all together launching all like a firecracker trigger, set-off to explode in sequence just after TOO may people jumped into the "head and shoulders" breakdown "set up".

..

The shorter term time frame charts do "appear" as if last week was "the real deal", and that the next pull back we get is a definite BUY. But to me, there are WAY to many of the longer term indicators saying otherwise. From my experience, the longer the time frame charts and indicators should always be given more clout.

..

Lots and lots of variables and smoke out there....if/when it total doubt the best trade at times is no trade.