I "think" that tomorrow is an up-day............

-Auto Sales data and ISM is on the docket tomorrow, and if "Cash for Clunkers" did anything, it will be or should be reflected in the data Tue.

As I posted yesterday, (see chart) today's move COULD be signaling that 988 is the next intermediate target. As this is a mirror of the the past set up, with the R shoulder being 10pts higher than the left last time, hence the 988 intermediate target here. I still don't think it happens in a straight line, as i cashed in my two small short plays for zero exposure tomorrow.

Case anyone missed here is a 40 minute interview w/ Robert Prechter talking about social moods......and his latest on the market.

http://pragcap.com/robert-prechter-the-rally-is-over

Disclosure: 100% cash

Sold all my EEV (7% gain in 1 week)

Sold all my DZZ (1% gain in 3 weeks)

Sold all my DBA, covered all my GLD short (pair: 5% gain in 5 months)

-Auto Sales data and ISM is on the docket tomorrow, and if "Cash for Clunkers" did anything, it will be or should be reflected in the data Tue.

As I posted yesterday, (see chart) today's move COULD be signaling that 988 is the next intermediate target. As this is a mirror of the the past set up, with the R shoulder being 10pts higher than the left last time, hence the 988 intermediate target here. I still don't think it happens in a straight line, as i cashed in my two small short plays for zero exposure tomorrow.

Case anyone missed here is a 40 minute interview w/ Robert Prechter talking about social moods......and his latest on the market.

http://pragcap.com/robert-prechter-the-rally-is-over

Disclosure: 100% cash

Sold all my EEV (7% gain in 1 week)

Sold all my DZZ (1% gain in 3 weeks)

Sold all my DBA, covered all my GLD short (pair: 5% gain in 5 months)

.....obviously not any homeruns here. As the quicker strike plays that I have gone for over the past 2 months are hitting about 40% accuracy, hence I am not too giddy to jump into those currently.

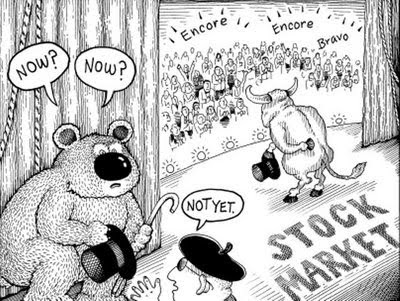

Something does not feel "right" here, and IMO the market is going to go much lower, but when??? no clue when. And even if now is when it should. It does not earn extra cash points to "catch the top". I would prefer to wait till its obvious the trend is back down, then just wait for a BOUNCE to short, than to play it heavy up here in the turbulence zone.

http://slopeofhope.com/2009/08/and-so-it-begins.html

Something does not feel "right" here, and IMO the market is going to go much lower, but when??? no clue when. And even if now is when it should. It does not earn extra cash points to "catch the top". I would prefer to wait till its obvious the trend is back down, then just wait for a BOUNCE to short, than to play it heavy up here in the turbulence zone.

http://slopeofhope.com/2009/08/and-so-it-begins.html

That is an example of what I mean. Jim Cramer hard at work? trying to BAN the bear ETF's?

That is to me, yet another sign that we are VERY near a top. However that could also cause another final spasm to the upside as well. (remember when they banned shorting the financials, oh yea, they had a lil pop from that, off an initial knee jerk reaction, yet also in retrospect recall how GREAT of an entry that gave to buy puts on them or go long SKF? any time there is a forced one sided trade, it just opens the door for a basically "gimme" reverse side trade immediatly after. 100% bulls and 0% bears = go short. Well, this bear ETF kinda noise smells like that to me. How far will they take this? No clue. However the further they do, the better future short it sets up. So heck, I hope they ban ALL short etf's tommorow and have forced liquidation. Because one the market starts to stall AFTER the initial pop it get's from that, well its as good of a short entry as their is. Whomever is in charge of these kinda decisions just must be out to lunch. Bears get all the blame for hurting the market, yet NONE of the credit for when it goes up. You want to know one of the reasons that the market has rallied so much? B/C bears keep trying to short it!!! (trust me, i know! lol) If they want to get rid of the bears here and now, then so be it. But the bears are the main reason the market remains in an uptrend.

This kinda action in regards to that e-mail about the bear ETF's reminds me alot of when they banned shorting the financials.

However as a bear, even though the charts appear to be signaling a move down, and 988 seems like a good target, I am cautious of TUE's data (car sales), and also of Friday's data (jobs)

However as a bear, even though the charts appear to be signaling a move down, and 988 seems like a good target, I am cautious of TUE's data (car sales), and also of Friday's data (jobs)