Since Sept 2008, the

INDU,

SPX and RUT are all right on the verge of retracing 50% of the down move from September. The $COMP is at around 57%. While the $

NDX is at 61%.

$

NDX is the "ONLY" index that made a higher low in March 2009, compared to Nov 2008, the only one.

If you take the Monthly, Weekly, Daily and 60min charts....the $NDX has cleaner patterns and channels on every single time frame than any other index.Ok, so the charts are very clean, got it. On to my hypothesis, which is this.....

#1: What the

difference in the

NDX vrs the COMP?

- well the

NDX is the Big Cap Tech, the COMP is all tech.

- Big Cap tech is

alot more stable, has more cash,

ie more market cap, less speculative,

and more household established.

#2: Why has

NDX been by leaps and bounds the strongest performing index since this became a bear market?

- Simple, they are the MOST removed from the financial crisis.

- Liars loans, excess leverage, real estate bubble, derivatives, etc etc. that all has a direct

relationship to the banks and brokers,

reits, and also since its credit related it has a

stronger impact on the smaller cap type stocks that have loans, and much less cash on

hand. Tech, most specifically large cap tech is the safe h

aven from all this.

#3: The $

NDX has been the safety trade here. It has not been the leader due to potential future growth potential. As if that were the case, the COMP would be neck n neck w/ the

NDX, as "growth potential" is more reflected in smaller caps going up in relation to larger caps. The bottom line is with "Large cap Tech" there there is the LEAST amount of chance of a

ponzi scheme, a dividend cut, a bail out, even an

eps miss with these stocks in the $

NDX. They have so much cash on hand, they can most easily cut costs to make numbers.

Another thing, that I think people forget

alot of the time is that Large Cap tech has one of the "least" amount of harm from deflation, as compared to other sectors. It "arguably" has almost none. With

telecoms actually being the least of all.

http://pragcap.com/performance-and-the-dollar-correlationAnd when you look at the sectors and without getting too "economist like" about it, it is pretty simple to

understand.

The closer it is to something tangible, that the consumer is buying with his/her US Dollar to live from (eat, build with, produce) that makes it the most inverse to the dollar.

The less tangible, and less related to something local to the the US is then less inverse to our local dollar. (

telecoms, tech, etc)

....and I digress.

People are not all piling into

GOOG because they think it's going to 1000

(it's not)

People are not all piling into

AMZN because they think it's going to expand 5X

(it's not)

People are not all piling into

INTC because they see it getting more market cap

(it's not)

These are rallying so much b/c they are safety trades, based on balance sheets.

When all the prior collapses were from suspect balance sheet stocks, it only makes

sense that the leader here on this "P2" is based on balance sheet strength.

However where is the growth? Revenues are declining. One can only cut costs to beat

eps for 1-2

qtrs, maybe 3. Eventually all the costs will be cut to the bone, and the only way to beat is via actual top line revenue growth.

...i digress again

Daneric had a very interesting speculation tonight, and I agree with it 100%.

http://danericselliottwaves.blogspot.com/2009/07/citibank-and-banking-laggards.html-The banks have lagged this entire move here very badly.

-According to the "

dow theory" fans out there, for this to be the "end" of a bear market, doesn't the same sector that led us down have to lead us out to the upside? (I really do not

understand why so many people are in love w/ the Transportation sector as some kinda of forever leading indicator signal.) It just seems like one of those things that way too many put too much stock into, and therefore it makes it actually worthless. Almost the same as being dead-set on trading the spy only, even when/if the

qqqq or

dia have a much cleaner set up. It just does not make

sense to me, being stubborn and using the same thing over and over again and not adapting or being open to new things can only hurt the bottom line, or at least that is how I am trying to see it here. If everyone is watching the

exact same set-up, its not a set up...it's a trap.

-Aside from the charts, I think we need a bearish capitulation to signal the "top" of P2 here. And I do not see that ending with this current sentiment here, there are some signs yes (such as

Roubini's more bullish call, etc). That is

defiantly a "bear capitulation" sign.

But its not there yet. We had Harry Dent on TV just last week "betting" Dennis

Kneale 1000 bucks that the

dow would be at 3,800 in 2010. (that's not bearish capitulation!!!)

-On to

dano's point. For us to reach a euphoric/climactic top here, it's going to have to be done with the financials. (NOT w/ big cap safety play tech!). I don't know what it is going to take to jump start them though. I mean we had Meredith Whitney, we had

Roubini. Yet looking at the $

BKX chart, one can not even tell that the market has had a 10% 2 week rally. It looks dead. Of course the Brokers have rallied huge. However the $

BKX is a bank index (not broker). Moving forward, no one knows "WHEN" it is going to happen, however we all know that eventually the fed lending rate is going to increase to higher than its current ZERO. That will put pressure on the banks. Since the market is forward looking, I can understand why they are not popping here, even with the 100,000,001 upgrades and pumps.

But to achieve bearish capitulation and reach the top here, I

don't see it happening any other way than there being "re-assurance" , well actually "false-assurance" that the Banking system is totally good to go. The money flow is still headed as FAR away as possible from anything even close to a "bank". (ie the $NDX!) Which is why, I

don't believe we have bear capitulation yet.

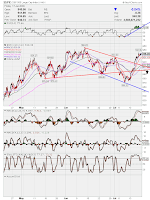

So for a longer term change of sentiment/direction, I am looking for 2 specific things:a) the

NDX chart to show a double top w/ neg weekly

divergence(there needs to be a signal, a strong one that this "safe" piggybank is totally full and no longer accepting deposits. When there is no more upside in the NDX, there will be no more upside in any index)b) a euphoric pop in the financials (mainly banking/$

bkx) sentiment.

(this is the only way to break the bears backbone and suck in all the last of the dumb retail into the game)